Securing the Future: UK Leisure Vehicle Security Market Trends

Discover key trends in UK leisure vehicle security and how to capitalise on this growing market. Unlock new revenue opportunities today.

SECURITY

Will Hawkins

2/28/20257 min read

Understanding the Security Market in the UK's Leisure Vehicle Sector

The UK leisure vehicle market is experiencing a significant shift in consumer behaviour regarding security solutions.

With over 4,600 monthly Google searches related to caravan, motorhome and campervan security, businesses have substantial opportunities to capitalise on this growing concern.

Our analysis of recent search data reveals compelling trends that can inform product development, marketing strategies and sales approaches for businesses operating in this sector.

Market Distribution and Search Volumes

The security concerns across leisure vehicle types show a clear pattern:

Caravan security leads with 2,300 monthly searches (49.8%)

Motorhome security follows closely with 1,800 monthly searches (38.9%)

Campervan security accounts for 520 monthly searches (11.3%)

The top keywords by search volume highlight the broad interest:

"Motorhome security" (320 monthly searches)

"Caravan security" (260 monthly searches)

"Campervan security" (210 monthly searches)

These search patterns indicate a stable and growing market across all three vehicle segments, with particular strength in the caravan and motorhome sectors.

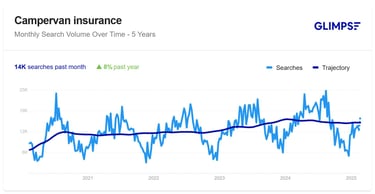

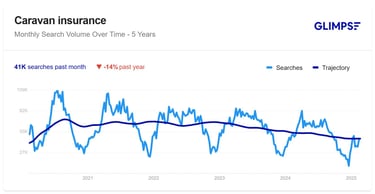

Insurance Trends and Security Implications

Click on the images to expand

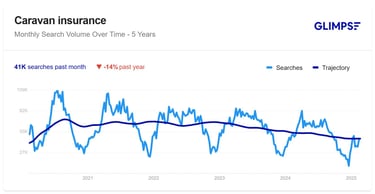

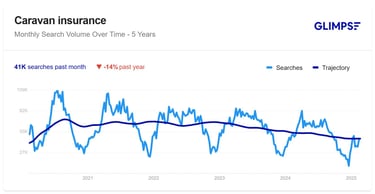

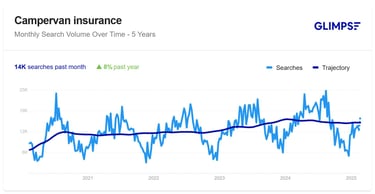

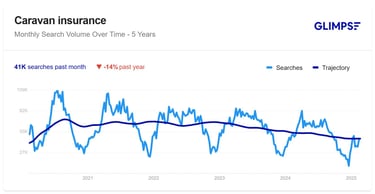

Recent Google Trends data reveals significant shifts in insurance-related searches that provide critical context for security product demand:

Campervan insurance searches increased by 8% (now ~14,000 monthly searches)

Motorhome insurance searches decreased by 8% (now ~18,000 monthly searches)

Caravan insurance searches decreased by 14% (now ~41,000 monthly searches)

Simultaneously, transactional keywords like "caravans for sale," "motorhomes for sale," and "campervans for sale" have declined amid challenging market conditions.

These trends create a complex picture for security providers. The growing campervan insurance search volume shows expanding ownership in this segment, despite broader market slowdowns. This emerging customer base represents fresh security product opportunities with fewer established security habits.

Conversely, the decline in caravan insurance searches is particularly notable since caravan insurance isn't legally required in the UK (unlike motorhome and campervan insurance).

This 14% drop suggests owners may be economising on non-mandatory expenses. This creates both challenges and opportunities for security providers. Security products that can be positioned as cost-effective alternatives to comprehensive insurance represent a compelling value proposition in this environment.

The contrasting trends between security searches (stable or growing) and insurance/sales searches (mostly declining) suggest that existing vehicle owners are increasingly prioritising physical protection of their assets during challenging economic conditions.

Security Threats and Risk Patterns

Recent insurance data provides critical context for search trends. Insurance experts at The Caravan and Motorhome Club say that caravan thefts go up at both the start and end of the summer holiday. This is exactly when owners are less careful. This correlates with increased search activity in March-April and again in August.

More alarmingly, North Yorkshire Police reported in February 2024 a significant rise in motorhome and caravan thefts driven by organised crime. Professional thieves are now targeting these vehicles to specific orders and to strip valuable contents like TVs, electronics and sports equipment.

These emerging theft patterns should inform how businesses position their security products and services, with an emphasis on combatting sophisticated threats and protecting not just the vehicle but its contents.

Consumer Priorities and Product Demands

The search data reveals clear preferences in security solutions:

Locks dominate the market (1,050 monthly searches)

Door locking solutions for habitation doors

Wheel clamps and security devices

Hitch locks and steering wheel locks

Alarm systems (390 monthly searches)

Motorhome alarms with motion sensors

Integrated security systems

Security cameras (380 monthly searches)

Surveillance for parked vehicles

Evidence collection capabilities

Security devices and trackers (370 monthly searches)

GPS and cellular tracking solutions

Remote monitoring capabilities

Advanced forensic identification systems

RFID-based solutions like VIN CHIP that enable long-range identification

Tamper-evident technologies that prevent vehicle cloning

Forensic marking systems that aid recovery after theft

This hierarchy of interest provides clear direction for product development and marketing priorities. Consumers are primarily seeking physical deterrents (locks), followed by detection systems (alarms and cameras), tracking technologies, and increasingly sophisticated forensic identification solutions.

Commercial Opportunities

From a business perspective, this market presents attractive commercial characteristics:

Average Cost-Per-Click of £0.44 indicates reasonable digital advertising costs

Low keyword difficulty (average 0.79) suggests SEO content can be highly effective

31% of search results display shopping ads, confirming commercial intent

76% of searches are informational or informational/commercial, suggesting consumers research before purchase

These metrics point to a market where educational content marketing can efficiently drive sales, with reasonable customer acquisition costs through both organic and paid channels.

Strategic Business Implications

1. Product Development Opportunities

The search data highlights several product development directions to pursue:

Integrated security packages: Combinations of locks, alarms and trackers tailored to specific vehicle types

Season-specific solutions: Winter storage security products, particularly focusing on wheel and hitch security

Anti-theft content protection: Solutions specifically addressing the theft of internal valuables

Professional thief deterrents: Advanced security features designed to thwart organised crime and theft-to-order situations

RFID-based identification systems: Implementation of technologies like VIN CHIP that offer forensic security through long-range RFID, tamper-evident labels, and secure registration databases

The growing sophistication of theft attempts requires equally advanced countermeasures.

RFID solutions like VIN CHIP represent a significant opportunity for businesses to offer next-generation security that addresses both prevention and recovery.

These systems provide a compelling alternative to traditional security measures by enabling identification from up to 30 metres away, making stolen vehicle recovery more efficient for law enforcement.

Businesses should consider how their product suite addresses these varied concerns, with particular attention to the differentiation between casual theft prevention, and protection against sophisticated criminal operations.

2. Marketing Strategy Recommendations

The data suggests several effective marketing approaches:

Educational content marketing: Create resources addressing the informational searches that dominate the market

Keyword targeting: Focus SEO and PPC efforts on high-volume terms with commercial intent

Seasonal campaigns: Time marketing pushes to coincide with the March-April and August search peaks

Vehicle-specific messaging: Tailor content to the specific security needs of caravan, motorhome and campervan owners

Insurance partnership: Highlight how security products can reduce insurance premiums and partner with insurers for distribution

Content should emphasise protection against professional thieves and address the specific vulnerabilities identified by insurance data, positioning products as investments rather than expenses.

Vehicle-Specific Marketing Considerations

The contrasting insurance search trends require nuanced marketing approaches:

Campervan sector (+8% insurance searches): Target this growing segment with security packages for new owners who may be less familiar with security risks. Emphasise the complementary relationship between mandatory insurance and security products.

Motorhome sector (-8% insurance searches): Focus messaging on protecting high-value investments during ownership retention periods. With declining sales searches, current owners are keeping vehicles longer and may prioritise enhanced protection.

Caravan sector (-14% insurance searches): Develop campaigns specifically highlighting security products as cost-effective alternatives to non-mandatory insurance. Position security devices as essential protection, given that many owners may be reducing insurance coverage.

3. Sales Strategy Enhancements

For direct sales teams and retail partners, consider:

Bundled security packages: Create tiered protection packages combining multiple security products

Insurance incentive selling: Stress premium reductions available with certified security features

Ease of installation: Focus on simple DIY installation as a key selling point

Value protection: Position security solutions as protecting the entire investment, including valuable contents

Sales materials should equip teams to explain the evolving nature of theft risks, particularly the growth in targeted theft-to-order operations.

4. Digital Presence Optimisation

With 76% of searches being informational, your digital strategy should include:

Mobile optimisation: Ensure all content works seamlessly on mobile devices

Video installation guides: Create demonstration videos for products showing easy setup

Forum engagement: Participate in leisure vehicle owner forums where security is discussed

Visual deterrent messaging: Emphasise how visible security measures provide preventative benefits

Extra security features: Highlight unique and innovative aspects of your products

This approach recognises that most consumers are researching before purchasing, making educational content a powerful sales driver.

Future Market Direction

The data indicates several emerging trends that will likely shape the leisure vehicle security market in the coming years:

Integration with smart home technology: Connected security systems extending to leisure vehicles

AI-powered monitoring: Advanced camera systems with anomaly detection

Community security networks: Shared alerts among vehicle owners

Insurance-linked tracking: Direct connectivity with insurance providers, like Caravan Guard Insurance, to verify security measures

Forensic identification adoption: Growing implementation of RFID and QR-based systems like VIN CHIP that combine prevention with enhanced recovery capability

The declining insurance search trends, particularly in the caravan sector where insurance isn't legally required, point to a potential market shift.

As owners reduce comprehensive insurance coverage due to economic pressures, they may seek alternative protection methods.

This represents a significant opportunity for security providers to position products as essential risk management tools rather than optional accessories.

Technologies like VIN CHIP's RFID system offer particularly promising growth potential as they address both sides of the security equation – discouraging professional thieves through visible and hidden markers, while significantly improving recovery prospects through ISO-certified registration systems and long-range identification capabilities.

For businesses, offering such solutions aligns with the growing consumer awareness that professional theft requires professional countermeasures.

The divergent trends between campervan growth and caravan/motorhome decline also suggest the security market may benefit from focusing innovation on new campervan owners while offering cost-effectiveness to the more mature caravan and motorhome segments.

Businesses positioned to address these nuanced market dynamics will likely capture growing market share, as consumer security needs evolve in response to economic conditions.

Frequently Asked Questions

What is the most effective marketing channel for leisure vehicle security products?

Search marketing (both organic and paid) appears most effective, given the high volume of informational searches. Educational content marketing that ranks for key terms like "motorhome security" and "protect your motorhome" can efficiently capture consumers in the research phase.

How seasonal is the security products market?

The data shows clear seasonal patterns with peaks in early spring (March-April) and late summer (August), aligned with the start and end of the leisure season. Marketing campaigns should be timed accordingly, with a particular focus on vulnerable periods identified by insurers.

Which vehicle segment offers the highest growth potential?

The campervan segment shows the strongest growth indicators, with an 8% increase in insurance-related searches despite overall market challenges.

While caravan security has the highest absolute search volume and motorhomes show stronger commercial intent based on CPC values, the campervan sector represents an expanding customer base actively seeking protection solutions.

This growth contrasts with the 8% decline in motorhome insurance searches and 14% drop in caravan insurance searches, suggesting shifting market dynamics favouring the campervan segment.

How should businesses respond to the increase in professional theft?

Product development should focus on advanced security features that specifically counter professional techniques. Marketing should educate consumers about these evolving threats, positioning premium security products as necessary protection against sophisticated criminals.

What emerging technologies show the most promise for combatting professional theft?

RFID-based forensic identification systems like VIN CHIP represent a significant development in combatting professional theft.

These systems combine preventative elements (tamper-evident labels, secure QR codes, hidden microdots) with enhanced recovery capabilities (long-range RFID readable from up to 30 metres).

The ISO-certified registration databases and 24/7 support centres further strengthen these solutions. Businesses should consider integrating or partnering with such technologies to offer comprehensive protection against increasingly sophisticated theft methods.

The UK leisure-vehicle-security market presents substantial opportunities for businesses that understand the nuanced concerns of vehicle owners.

By aligning product development and marketing with search trends and the risk patterns identified, companies can capture growing demand, while providing genuine value to a market increasingly concerned about sophisticated theft threats.

Insights

Stay updated with trends in outdoor leisure.

Subscribe

Connect

Call +(44) 07725 003675

© 2026 Digi-Business Ltd All rights reserved

Tools

Registered Address:

The Adventure Business Update

c/o Digi-Business Ltd (t/a Digital Business)

Lytchett House

13 Freeland Park

Wareham Road

Poole

Dorset

BH16 6FA